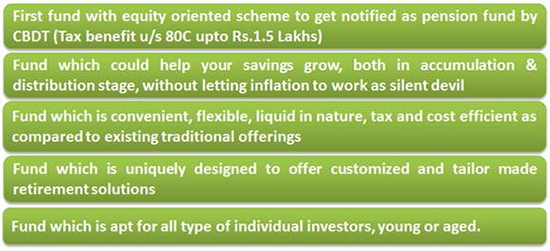

“RETIRE” can be elongated as “ Relax, Entertain, Travel, Indulge, Read, Enjoy”. However, as the age goes “ It’s not only at what AGE You Retire is Important, but with what INCOME You Retire is also Important”. Reliance Mutual Fund presents a Comprehensive Retirement Solution namely Reliance Retirement Fund

Features of the scheme:

| Parameters | Details |

| Asset Allocation | Wealth Creation Scheme |

| Diversified Equities & Equity Related Securities - 65% - 100% | |

| Debt & Money Market Securities – 0% - 35% | |

| Income Generation Scheme | |

| Diversified Equities & Equity Related Securities - 5% - 30% | |

| Debt & Money Market Securities – 70% - 95% | |

| Fund Managers | Sanjay Parekh (Equity), Anju Chajjer (Debt), Jahnvee Shah (Overseas Investments) |

| Benchmark | Wealth Creation Schem: S&P BSE 100 Index Income Generation Scheme: Crisil MIP Blended Index |

| Exit Load | - 1% if redeemed/switched out from Reliance Retirement Fund before attainment of 60 years of age. |

| - Nil in case of Auto SWP/Redemption/Switch out from Reliance Retirement Fund on or after attainment of 60 years | |

| of age or after completion of 5 year lock in period, whichever is later. | |

| - Nil in case of switch made from Wealth Creation Scheme to Income Generation Scheme or vice versa | |

| - Nil in case of Auto Transfer from Wealth Creation Scheme to Income Generation Scheme | |

| Note: Age will be computed with reference to years completed on the date of transaction | |

| Plans and Options | Growth Plan : Growth Option & Bonus Option |

| Dividend Plan : Dividend Payout Option | |

| Minimum Application Amount | - Lumpsum: Rs.5,000 & in multiples of Rs. 500 thereafter |

| - Monthly SIP: Rs. 500 & in multiples of Rs.500 thereafter for minimum of 12 months | |

| - Quarterly SIP: Rs.1,500 & in multiples of Rs.500 thereafter for minimum of 4 quarters | |

| - Annual SIP: Rs. 5,000 & in multiples of Rs.500 thereafter for minimum of 2 years | |

| - Additional Minimum Application Amount (Lumpsum): Rs. 1,000 & in multiples of Rs.500 thereafter | |

| Minimum Amount for Auto SWP | - Monthly Frequency: Rs. 500 & in multiples of Rs.500 thereafter |

| - Quarterly Frequency: Rs.1,500 & in multiples of Rs.500 thereafter | |

| - Annual Frequency: Rs. 5,000 & in multiples of Rs.500 thereafter | |

| Additional Tax Benefit | Investment made in the scheme will qualify for a deduction from Gross Total Income upto Rs.150,000/- (along with |

| other prescribed investments) under section 80C of the Income Tax Act, 1961. | |

| Who Can Invest | - Adult Resident Indian Individuals, either single or jointly (not exceeding three). |

| - Non - resident Indians and persons of Indian origin residing abroad, on a full repatriation basis | |

| - Parents/Lawful guardians on behalf of Minors | |

| Currently, Individuals qualify for tax benefits U/S 80C of Income Tax Act, 1961. |

Scheme Specific Risk Factors:

Trading volumes and settlement periods may restrict liquidity in equity and debt investments. Investment in Debt is subject to price, credit, and interest rate risk. The NAV of the Scheme may be affected, inter alia, by changes in the market conditions, interest rates, trading volumes, settlement periods and transfer procedures. The NAV may also be subjected to risk associated with investment in deriva¬tives, foreign securities or script lending as may be permissible by the Scheme Information Document. The Central Government specifies Reliance Retirement Fund as a pension fund for the purpose of clause (xiv) of sub-section (2) of section 80C of the Income Tax Act, 1961 (43 of 1961) for the assessment year 2015-16 and subsequent assessment years. Tax benefits are as per current Income tax laws and Rules

Disclaimers:

The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent profes¬sional advice, verify the contents in order to arrive at an informed invest¬ment decision. None of the Sponsor, the Investment Manager, the Trustee, their respective directors, employees, affiliates or representatives shall be liable in any way for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including on account of lost profits arising from the information contained in this material.

* Mutual Fund investments are subject to market risks, read all scheme related documents carefully